Friday, April 29, 2011

Gold rose to new record nominal highs at $1,540.85/oz in early Asian trading last night. Silver and gold remain very close to nominal highs today as the beleaguered US dollar remains under pressure due to ultra loose US monetary policies, deepening inflationary price pressures and concerns about the feeble economic recovery.

Cross Currency Table

Gold has risen 8% this month and silver 28% due to the very poor US monetary and fiscal position, the Eurozone debt crisis and in the background the Japanese nuclear crisis, and geopolitical instability in the Africa and the Middle East. This is continuing to lead to diversification into the precious metals.

COMEX Silver Default?

A number of readers contacted us yesterday to comment critically on our advice to “as ever” … “ignore the daily noise and focus on the long term and the fundamentals driving these markets.”

Comex Silver Inventory Data

They felt that it was linked to the paragraph above regarding a possible COMEX default and was suggesting that rumours of a run on COMEX depositories was “noise”.

We were not suggesting that and with hindsight the juxtaposition of this sentence in the immediate aftermath of the paragraph regarding the COMEX was unfortunate and ripe for misinterpretation.

Let us reiterate a COMEX default on delivery of precious metals and specifically of silver bullion bars is far from “noise”. It is of significant importance and that is why we have covered its possibility for some months. A COMEX default would have massive ramifications for precious metals markets, for the wider commodity markets, for the dollar, fiat currencies and our modern financial system.

Silver surged 3.4% yesterday to settle at a 31-year nominal high, and rose by $1.55 on the day. Silver is up some 28% in April alone. The last time this happened was when Warren Buffett took a large stake in silver in 1987 and there were rumours of Buffett “cornering the market”.

Silver remains in backwardation and the possibility of a COMEX default cannot be ruled out – especially as silver bullion inventories are very small vis-a-vis possible capital allocations to silver in the coming weeks and months.

The possibility of an attempted cornering of the silver market through buying and taking delivery of physical bullion remains real and would likely lead to a massive short squeeze which could see silver surge to well over its inflation adjusted high of $140/oz.

Indeed, a recent article in the Financial Times suggested that private or state interests with very deep pockets are attempting to corner the silver market. Bizarrely, this massive story which mooted the possibility of Russian billionaires, Chinese traders and even the People’s Bank of China and other central banks secretly buying silver, has subsequently been barely reported or commented on.

There are now two “conspiracy theories”. One is the long side conspiracy theory which claims, a la the FT, that there are foreign private and state actors attempting to corner the silver market through secret buying.

The other is the more long-standing short side conspiracy theory which has gained credence in recent months due to the CFTC’s investigation into silver manipulation by Wall Street banks, such as JP Morgan, who have massive concentrated positions. This theory has been backed up by some circumstantial evidence by GATA and has recently gone “viral” through the campaign of financial journalist Max Keiser.

The theories are not mutually exclusive and may be true. Indeed, Chinese, Russian and other private interests may be cornering the physical market in an effort to end manipulation of the silver market by Wall Street banks in order to ensure the silver price rises very sharply and creates significant profits on their silver bullion holdings.

Indeed, if the People’s Bank of China is involved – profit may not be the end game, rather the positioning of the Chinese yuan as the new reserve currency through use of gold and silver bullion reserves.

Bloomberg Link Precious Metals Conference

The Bloomberg Link Precious Metals Conference heard a wide range of opinions from precious metal experts and mining executives. The vast majority believed that gold and silver’s strong fundamentals (especially due to anaemic supply and strong demand) should result in prices continuing to rise in the coming years.

The knowledge amongst the participants regarding the fundamentals is in stark contrast to many so-called financial or market experts in the press who continue to be misinformed regarding the gold and silver markets (see news).

The knowledge amongst the participants is also in stark contrast to much of the western public (particularly in European countries), many of whom continue to believe that “cash is king” and remain unaware that they are very exposed to sovereign debt default risk, currency debasement and inflation.

The one participant who was bearish on silver was William Hamelin, the president of Ames Goldsmith Corp., who forecast a drop to $35.85/oz by year-end. Hamelin’s company processes silver for use in a number of consumer products, such as electronic components, batteries and photography.

Gold in Euros to Play Catch up?

Gold’s recent rise has not been solely US dollar related as gold has risen to new record nominal highs in British pounds and yen. Gold has underperformed in euros recently and yet remains only 3.7% below the record nominal high of €1,072/oz seen four months ago in December 2010.

The euro’s strength is not due to German economic strength or due to positive fundamentals rather it is purely due to the fundamentals of the dollar, the pound, the yen and other fiat currencies being very poor. It also may be due to short covering as those short the euro are forced to buy back positions.

Gold in EUR – January 2010 to April 2011

Gold’s continuing strength in euros suggests that the recent bout of euro strength versus the dollar and other fiat currencies will be short lived and the euro will come under pressure again in the coming months.

Gold in euros has risen 2% in April. It will be interesting to see if euro gold replicates the performance of April and May last year when Eurozone sovereign debt concerns saw gold rise to €825/oz to over €1,000/oz prior to a correction. Previous resistance at €1,000/oz gold looks to be strong support for gold.

Gold

Gold is trading at $1,535.80/oz, €1,034.28/oz and £922.73/oz.

Silver

Silver is trading at $48.75/oz, €32.83/oz and £29.29/oz.

Platinum Group Metals

Platinum is trading at $1,844.00/oz, palladium at $780/oz and rhodium at $2,250/oz.

Social bookmarksEmail this article Print this pageComment Terms Of Use

Login

Username:

Password:

Remember me

Register

Lost your password?

5 Responses to “Secret Silver Buying by Russian Billionaire, Chinese Traders, and People’s Bank of China to Lead to Comex Silver Default?”

ectoendomezo Says:

April 29th, 2011 at 7:38 am

HAS ANYONE HEARD OR..DOES ANYONE KNOW..ANYTHING ABOUT THE FOLLOWING “SILVER QUESTIONS”?:

1) THE USE AND NEED FOR SILVER IN THE “SHADOW” WORLD? GOVERNMENT SATELLITE PROGRAMS/MILITARY/NASA/ANTI-GRAVITY ETC..(?)

2) THE POSSIBILITY THAT….SILVER…COULD SURPASS ITS “TRADITIONAL 1/12 RATIO” WITH GOLD?

IF NASA FOR EXAMPLE..WERE TO BE “HOLDING” SOME SECRET BACK..SOMETHING HAVING TO DO WITH ANTI-GRAVITY TECHNOLOGY..OR TECHNOLOGY THAT UTILIZES “SILVER”…WHAT DO YOU THINK WOULD HAPPEN IF THEY WERE TO RELEASE THAT INFORMATION..”SUDDENLY”…SAY IN “MAY”?

OR IF THE GOLD IN THE “VAULTS” WAS THE SUBJECT OF A “DEMAND FOR TESTING”..LIKE BY…SAY…”CHINA”…WHAT WOULD HAPPEN TO THE PRICE OF SILVER?

JUST WONDERING…..

komideo Says:

April 29th, 2011 at 7:39 am

SECRET SILVER. SECRETS! SECRETS! SECRETS! WANNS KNOW THE BIGGEST SECRET?

It’s This… *** ARMAGEDDONWARS.COM ***

Bacchus Says:

April 29th, 2011 at 8:07 am

Take off the gold earrings that your wives, your sons and your daughters are wearing, and bring them to me. So all the people took off their earrings and brought them to Steve Jobs at Apple. He took what they handed him and made it into an idol cast in the shape of a computer, fashioning it with a tool. Then they said, “These are your gods”.

BiGpharmakillZ Reply:

April 29th, 2011 at 9:21 am

LOL, that’s about it.

Charles Nunya Says:

April 29th, 2011 at 9:57 am

This is probably a short term play to make some large profits.

Truenews to keep your freedom!Get out of the dinosaur dying lying mainstream media!Tired of being lied to and deceived yet?Here is a fresh source of news and information to help you sort through the fog of deception that is constantly put out!We all know that the media and politicians had been bought and paid for a long time ago!They keep telling us things are getting better and they are going to fix it,but we all know in our hearts that this is just another lie!Sooner we wake up the better!

The System works because you work!

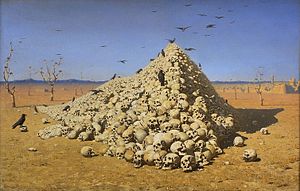

DEATH BY GOVERNMENT: GENOCIDE AND MASS MURDER

All told, governments killed more than 262 million people in the 20th century outside of wars, according to University of Hawaii political science professor R.J. Rummel. Just to give perspective on this incredible murder by government, if all these bodies were laid head to toe, with the average height being 5', then they would circle the earth ten times. Also, this democide murdered 6 times more people than died in combat in all the foreign and internal wars of the century. Finally, given popular estimates of the dead in a major nuclear war, this total democide is as though such a war did occur, but with its dead spread over a century

Popular Posts

-

March 30, 2011, 02:52:59 PM Welcome, Guest . Please login or register . 1 Hour 1 Day 1 Week...

-

Translate this page: Select Language Afrikaans Albanian Arabic Belarusian Bulgarian Catalan Chinese (Simplified) Chinese (Traditio...

-

Dan Kitwood/Getty; Whitehotpix/ZUMAPRESS.com Pippa Middleton, Kate Middleton's younger sister, has a wild side, according to ...

-

On Fema camps Watch this! http://www.youtube.com/watch?v=6Dys3xE2Bnk On 911 http://www.youtube.com/watch?v=E_YCbj9rqzw&feature=rela...

-

> James Middleton naked photos circulate online as frenzy over sister Pippa Middleton skyrockets BY Shari Weiss DAILY NEWS STAFF...

-

Pippa Middleton bikini pictures surface while family tries to stop spread of topless photos BY Shari Weiss DAILY NEWS STAFF WRITE...

-

Beyonce, Jay Z Cuba Trip 'Fully Licensed' by US... <click here

-

Kurt Nimmo and Alex Jones Infowars.com May 2, 2011 CNN and the corporate media report this evening that purported CIA asset Osama bin La...

-

Fall Of The Republic documents how an offshore corporate cartel is bankrupting the US economy by design. Leaders are now declaring that w...

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment