Reuters – Two men inspect laptop computers while shopping in a Best Buy store in New York April 13, 2011. REUTERS/Lucas …

. Play Video Economy Video:Unemployment Claims Rise as GDP Falls CNBC .

Play Video Economy Video:Jobless Claims & Q1 GDP CNBC .

Play Video Economy Video:What Cramer Wants From Ben Bernanke TheStreet.com .

By Lucia Mutikani Lucia Mutikani – 1 hr 47 mins ago

WASHINGTON (Reuters) – Economic growth braked sharply in the first quarter as higher food and gasoline prices dampened consumer spending and sent inflation rising at its fastest pace in 2-1/2 years.

Another report on Thursday showed a surprise jump in the number of Americans claiming unemployment benefits last week, which could cast a shadow on expectations for a significant pick-up in output in the second quarter.

Growth in gross domestic product slowed to a 1.8 percent annual rate after a 3.1 percent fourth-quarter pace, the Commerce Department said. Economists had expected a 2 percent pace.

With much of the pull back traced back to sharp cuts in defense spending and harsh winter weather, analysts were hopeful the economy would regain speed in the second quarter. The drop in defense spending was seen as temporary.

"Growth was disappointing given the momentum of the economy heading into the year. We are still of the belief that the economy will improve out of the soft patch through this quarter into the second half of the year," said Brian Levitt, an economist at OppenheimerFunds in New York.

Economists were encouraged that details of the report, in particular consumer spending and business outlays on software and equipment, were not as weak as they had feared and said this suggested a foundation for stronger growth was in place.

Consumer spending accounts for about 70 percent of U.S. economic activity.

LABOR MARKET WEAKNESS?

While a 25,000 rise in claims for state jobless benefits to 429,000 last week hinted at some weakening in the labor market, analysts cautioned against reading too much into gain. They said severe weather in some parts of the country and the Easter holiday could have distorted the figure.

Still, the data suggested improvements in the labor market were still only coming grudgingly.

"The underlying downtrend in initial claims that had been in place since late last year has flattened out," said Omair Sharif, an economist at RBS in Stamford, Connecticut. But he added: "It seems a little too early to suggest that the underlying pace of layoffs has picked up."

Hiring accelerated in March and a report next week is expected to show job creation remained relatively robust in April.

MODERATE PACE

Prices for U.S. government debt rose after the data, while stocks edged lower. The weak GDP report and the Federal Reserve's stated commitment to a loose monetary policy stance after a two-day meeting on Wednesday kept the dollar near a three-year low against a basket of currencies.

The Fed on Wednesday trimmed its growth estimate for 2011 to between 3.1 and 3.3 percent from a 3.4 to 3.9 percent January projection.

Some economists felt the U.S. central bank's estimates might be a little optimistic, given the poor start to the year even though most agreed growth would soon strengthen.

Optimism the economy would find a firmer footing in the second quarter was bolstered by a report showing pending sales of previously owned homes rose 5.1 percent in March. Housing is struggling to recover and is one of the headwinds facing the economy.

Growth in the first quarter was curtailed by a sharp pull back in consumer spending, which expanded at a rate of 2.7 percent after a strong 4 percent rise in the fourth quarter.

Rising commodity prices meant consumers had less money to spend on other items. Gasoline prices remain a concern, even though they are expected to stabilize somewhat.

INFLATION RISING

The GDP report underscored the pain that strong food and gasoline prices are inflicting on households.

A inflation gauge contained in the report rose at a 3.8 percent rate -- the fastest pace since the third quarter of 2008 -- after increasing 1.7 percent in the fourth quarter.

A core price gauge, which excludes food and energy costs, accelerated to a 1.5 percent rate -- the fastest since the fourth quarter of 2009 -- from 0.4 percent in the fourth quarter. The core gauge is closely watched by Fed officials, who would like to see it closer to 2 percent.

In the first quarter, restocking by businesses picked up, with inventories increasing $43.8 billion after a $16.2 billion rise in the fourth quarter. However, the buildup was less than economists had expected and some said they looked for further inventory building to bolster growth in the second quarter.

Inventories added 0.93 percentage point to first-quarter GDP growth. Excluding inventories, the economy grew at a pedestrian 0.8 percent pace after a brisk 6.7 percent rate in the fourth quarter.

Business spending on equipment and software gained pace, but government spending suffered its deepest contraction since the fourth quarter of 1983.

Home building made no contribution, while investment in nonresidential structures dropped at its quickest pace since the fourth quarter of 2009, likely the result of bad weather.

(Additional reporting by Mark Felsenthal; Editing by Neil Stempleman)

13,630 CommentsShow: Newest FirstOldest FirstHighest RatedMost Replied Post a Comment Comments 1 - 10 of 13630

FirstPrevNextLast409 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 16 users disliked this commentjohn b Thu Mar 17, 2011 01:53 pm PDT Report Abuse I don't believe them! My food bill has gone up 22% over last year at this time. I pretty nuch buy the same stuff and haven't gained or lost weight. I know my gas at the pump has gone up 60 cents in the last month. My electric bill is up $15 a month average. I use the power companies same payment program. I now pay $150.00 a month.

The things the use to calculate inflation I don't use. My house payment is the same. What numbers are they using to calculate this?

These people are just crazy to think we will fall for this.Replies (23) .102 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 1 users disliked this commentunforgiven Fri Mar 18, 2011 12:47 am PDT Report Abuse Consumer prices increased because of the FED's "QE2" drive the dollar down and inflation up crusade. Higher prices are NOT due to more demand as they would like you to believe.Replies (2) .298 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 14 users disliked this commentsharon Fri Mar 26, 2010 01:30 am PDT Report Abuse The lower rate of unemployment might also be reflected with those that have used all of their benefits, which would lower the rate.Replies (9) .260 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 13 users disliked this commentTWELFTHMAN Fri Mar 04, 2011 11:15 pm PST Report Abuse Actually, the numbers of unemployed that have exhausted benefits and are falling off of the "unemployed" rolls are increasing.

This just seems to make the unemployment numbers appear better or improved.

Ask your fellow citizens out there how much better their situation is. The story might be a bit different than this article is trying to report.Replies (1) .402 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 23 users disliked this commentPaul Bong Sat Mar 05, 2011 04:00 am PST Report Abuse This rebound sure hasn't hit the state of Florida yet. Unemployment here is 13%.Replies (31) .251 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 13 users disliked this commentThu Mar 03, 2011 07:32 pm PST Report Abuse i have burning my @#$% all week to buy a new set of tool and guess what , is almost impossible to buy MADE IN THE U.S.A tools , sad sad sadReplies (25) .188 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 9 users disliked this commentEdgar1 Fri Mar 26, 2010 02:36 am PDT Report Abuse Ah author, jobless claims fell because over 200,000 lost their benefits in February and so far this month.Replies (6) .376 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 26 users disliked this commentRay Wed Mar 24, 2010 11:50 pm PDT Report Abuse Thousands are loosing unemployment. No jobs here in Nevada, that's for sure. With the Billions poured in by the Fed, there should be a little effect, but hang on the worst is yet to come. Round 2 is on the way.Replies (11) .196 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 12 users disliked this commentPRO Fri Mar 04, 2011 10:22 pm PST Report Abuse "Unemployment, as measured by Gallup without seasonal adjustment, hit 10.0% in mid-February -- up from 9.8% at the end of January."

"The percentage of part-time workers who want full-time work worsened considerably in mid-February, increasing to 9.6% of the workforce from 9.1% in January."

go to the gallup website and see for yourself, it will take you about 5 seconds to find it. anyone who thinks things are getting better is a fool.Replies (7) .218 users liked this comment

Please sign in to rate this comment up.

Please sign in to rate this comment down. 14 users disliked this commentRichardTheLionheart Wed Mar 09, 2011 06:40 am PST Report Abuse What an idiot. Economy recovering?? In what country would that be? You call yourself a journalist? What a freaking jokeReplies (3) ..Comments 1 - 10 of 13630

FirstPrevNextLa

Truenews to keep your freedom!Get out of the dinosaur dying lying mainstream media!Tired of being lied to and deceived yet?Here is a fresh source of news and information to help you sort through the fog of deception that is constantly put out!We all know that the media and politicians had been bought and paid for a long time ago!They keep telling us things are getting better and they are going to fix it,but we all know in our hearts that this is just another lie!Sooner we wake up the better!

The System works because you work!

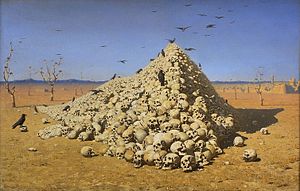

DEATH BY GOVERNMENT: GENOCIDE AND MASS MURDER

All told, governments killed more than 262 million people in the 20th century outside of wars, according to University of Hawaii political science professor R.J. Rummel. Just to give perspective on this incredible murder by government, if all these bodies were laid head to toe, with the average height being 5', then they would circle the earth ten times. Also, this democide murdered 6 times more people than died in combat in all the foreign and internal wars of the century. Finally, given popular estimates of the dead in a major nuclear war, this total democide is as though such a war did occur, but with its dead spread over a century

Popular Posts

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment